5 ESSENTIAL RULES

used to identify the Right Entry Price of a New Launch or Resale Property

New Launches vs Resale?

Which is Better?

Why RESALE Prices are cheaper than New Launches? Does it mean that we should buy if it is CHEAP?

Have you ever wonder why the resale prices are much cheaper and yet many people still choose to pay more for New Launches?

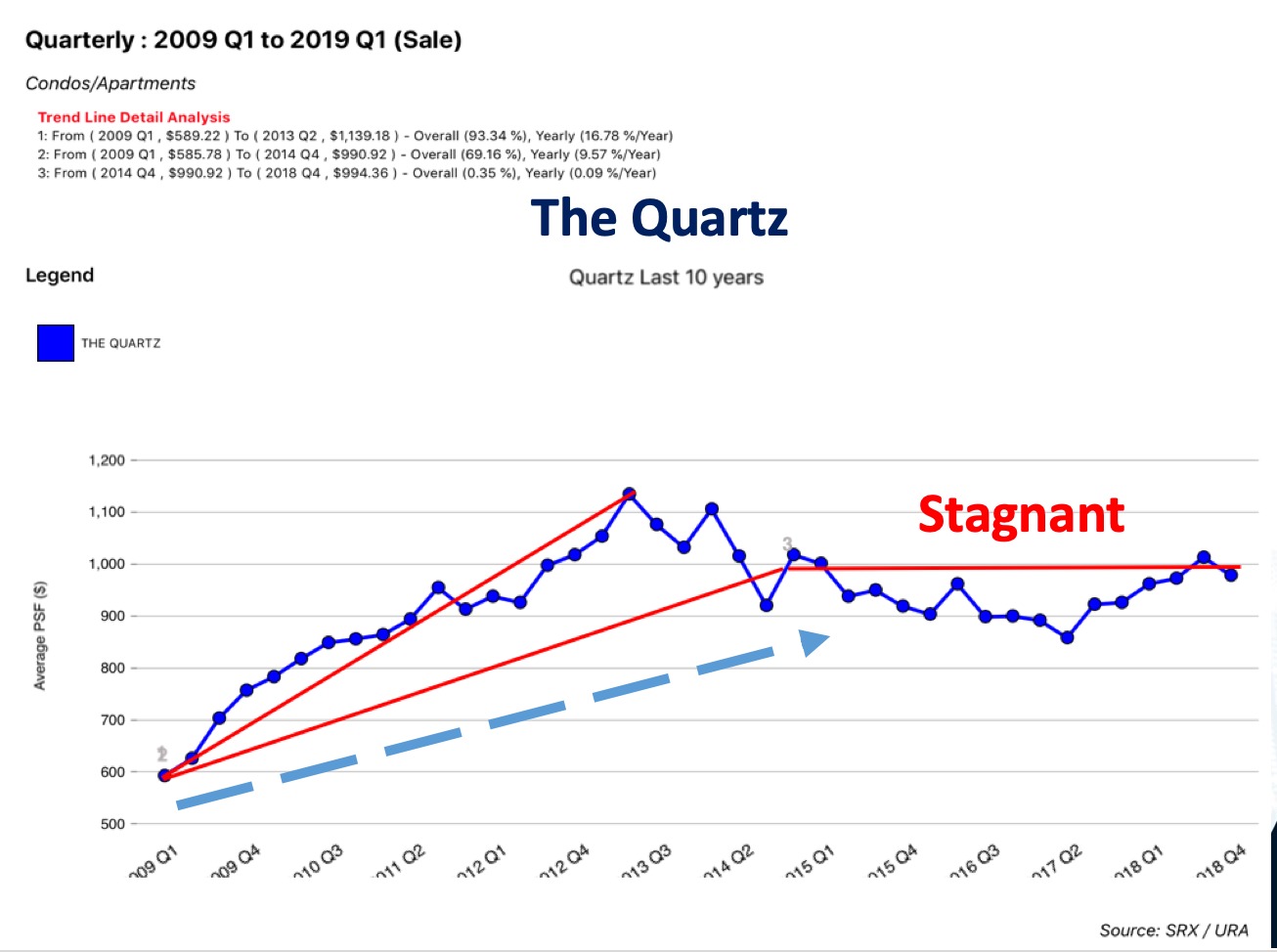

Just look at the chart on the right, why are the prices not moving in the last 4 years?

So the Question now is :

Is it Worth to Buy New Launch or Resale?

MAD RUSH TO SNATCH A UNIT ...

IS THIS REALLY THE BEST DEAL???

This happened during a new launch where everyone is trying to get a unit. Will you buy when you see this situation in the showflat? Many times, we saw people interpret long queues as buying good deal and will rush to get a unit when they see such situation. When this happens, I always refer it as the “Kiasu” syndrome.

Is this the way to determine the RIGHT ENTRY PRICE? I have seen many people making such decision without differentiating right from wrong. Do you know that one mistake make by emotion may cost you more than hundreds of thousands of dollars? Hence, in this sharing session by me, I will be covering 5 Essential Rules for you to take note when identifying the RIGHT ENTRY PRICE property.

5 Essential Rules

1. Supply Vs Demand

2. Location Vs Entry Price

3. Spot Safe Entry Price Asset

4. Potential Upside/ Risk

5. First Mover Advantage

Just based on the above 5 Rules that you will learn from me, I am sure you will not make the wrong decision in selecting the right property. Even if you have not buy or bought, you should be here to learn this skill from me.

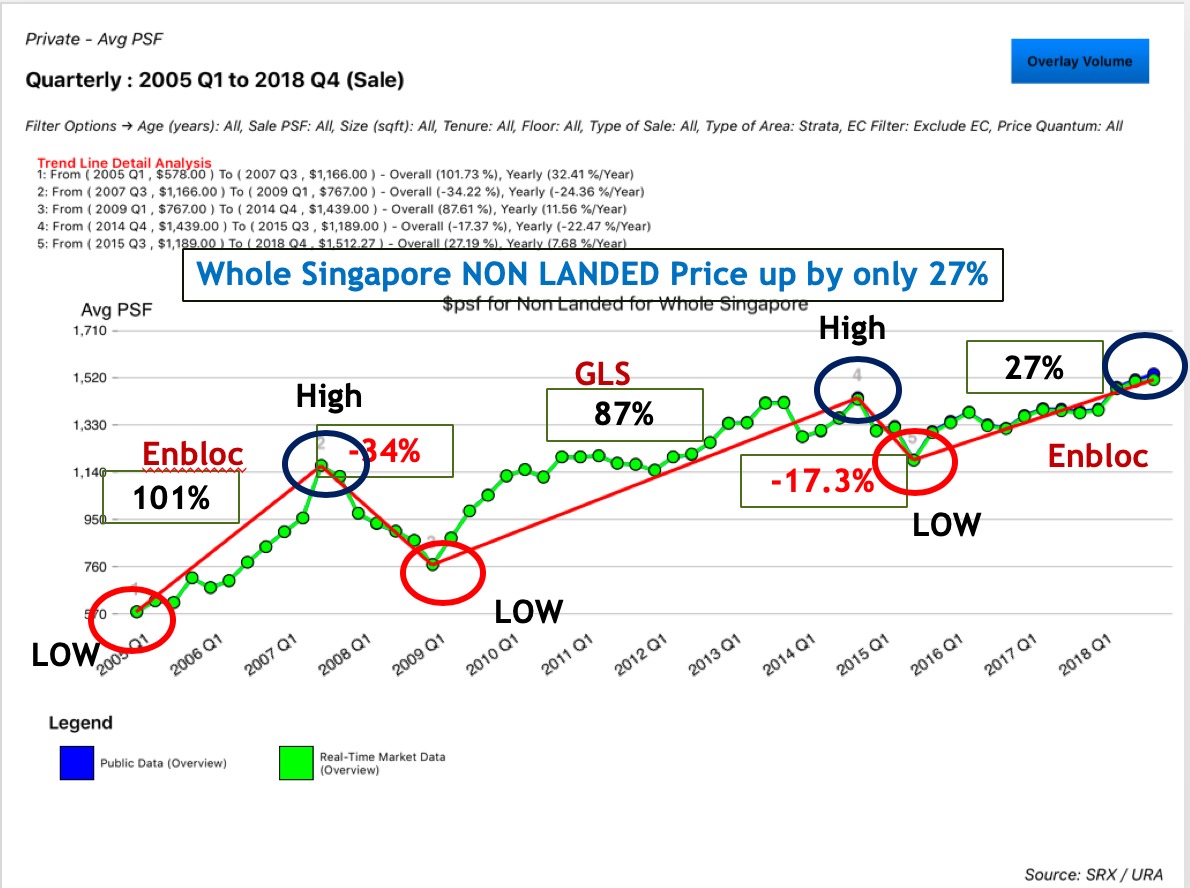

MUST KNOW - Understand the Charts that will help you identify the RIGHT Entry Price Property!

Look at this chart below, this is another very important chart that you must know! I have made all of my the property investment based on the understanding of this chart. If you can master it well, I am very sure you will be able to know how to identify the Right Entry Price Property that will help you make money.

Find out what is best for you with

PropNex Associate Group Director,

Jayson Ang

With his career experience of more than 5 years, he has curated a set of asset progression which has benefited his clients greatly. For current and aspiring Singapore property investors, his role is to help them invest wisely. Not only that, he has consistently minimised many of his clients’ risks by leveraging on the most suitable loans available, while maximising the profit potential of their investments.

Being a property investor, he has never invest based on speculation and emotion buying. Using his experience and hard facts and figures, he determines the RIGHT property to invest.

To put his knowledge into writing, Jayson also wrote a book – Asset Progression Checklist, in 2019. The book coaches investors step-by-step guides on conducting researches before purchasing their properties.

Cited with real life case studies, Jayson pens down realistic and detail methodology which ensures reader to grow their wealth in a predictable way.

REQUEST A CONSULTATION!

Interested to know more info?

Register Here for In-Depth Consultation Today!