Discover why Singaporeans love London and are snapping up London Property like hotcakes …

Any thoughts of a decline in interest in London from Singaporean property buyers and investors were brushed aside last weekend when two prominent developments from the United Kingdom capital showcased in the city-state.

Although Doris Tan, Director of International Residential Sales at Singapore real estate agency JLL admitted August had been traditionally quiet, she told PropertyGuru her calendar was completely booked with overseas projects – especially from London – for the rest of the year.

Jon Hall, Sales and Marketing Director for join-developers Mount Anvil, told PropertyGuru: “The United Kingdom is the main market for London properties at the moment, but Singapore, Hong Kong, Dubai, Mainland China and increasingly Malaysia are the places we need to be to sell overseas.”

Richard Levine, Director for International Properties Southeast Asia, reported he was equally busy with London projects and noted his company had the best six-month period for overseas properties ever.

Prices at both London developments started close to the S$2million mark, and both were making their first venture overseas to Singapore after opening sales in their home country.

Source : Propertyguru

Featured Property

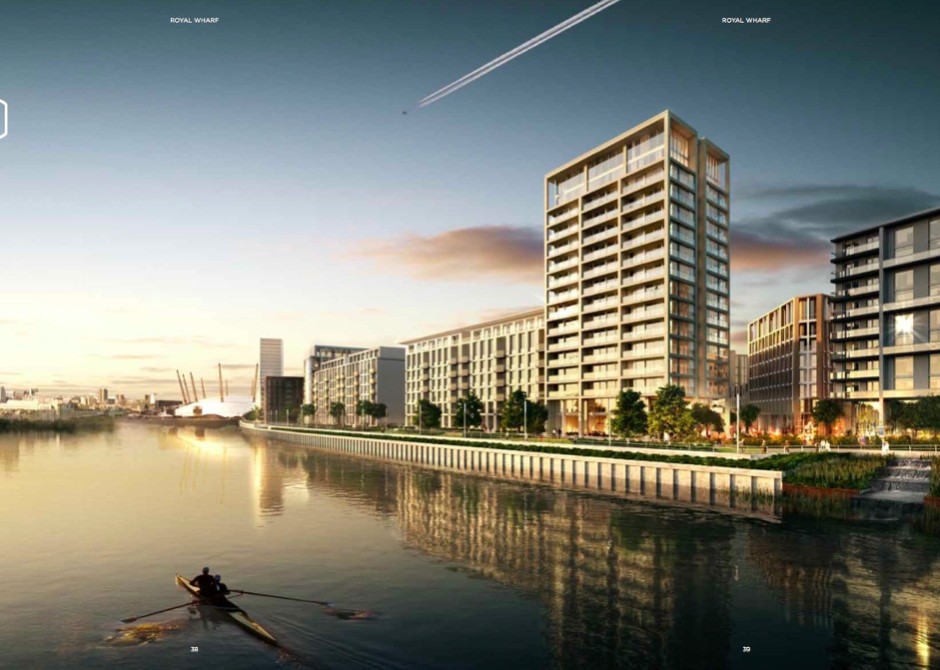

ROYAL WHARF LONDON

Royal Wharf London

Royal Wharf London

Where is the Next Best Place to Invest with Higher Returns?

Invest in countries that attracts High Foreign Direct Investments, welcomes foreign labours, which would translate with returns that command higher rental yields than in Singapore.

The Bridge, Phnom Penh, Cambodia – 39% Guaranteed Rental Return by Oxley over 6 years

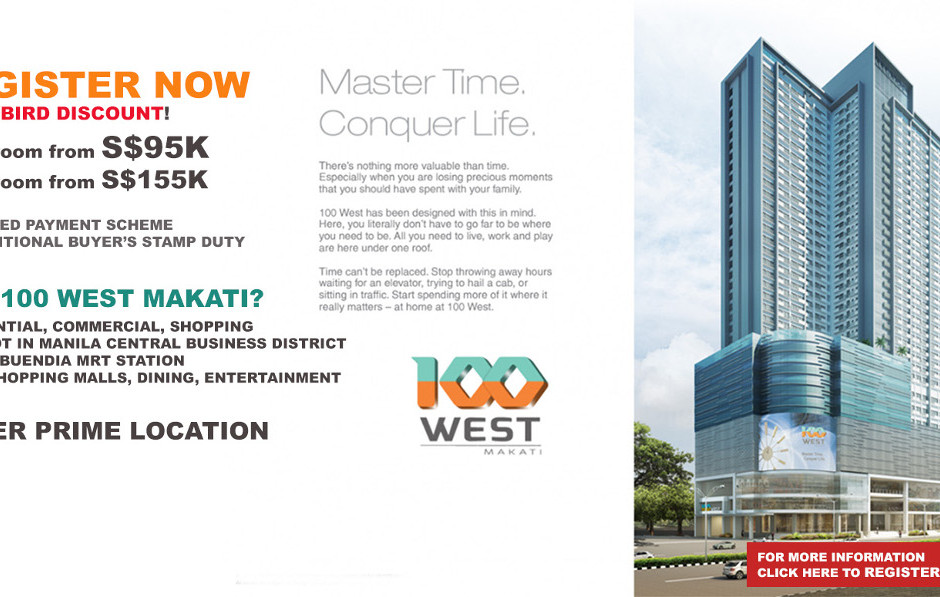

100 West Makati – 7 to 8% Rental Yield based on current market data

With lower cash outlay and quantum, high rental yield due to limited supply of condos, would it makes sense to invest in those places? You could be one of those savvy investors with 1st Mover Advantage!

Call +65 91898321 to find out how to make your money work harder for you!