Where to Invest with no ABSD and no SSD?

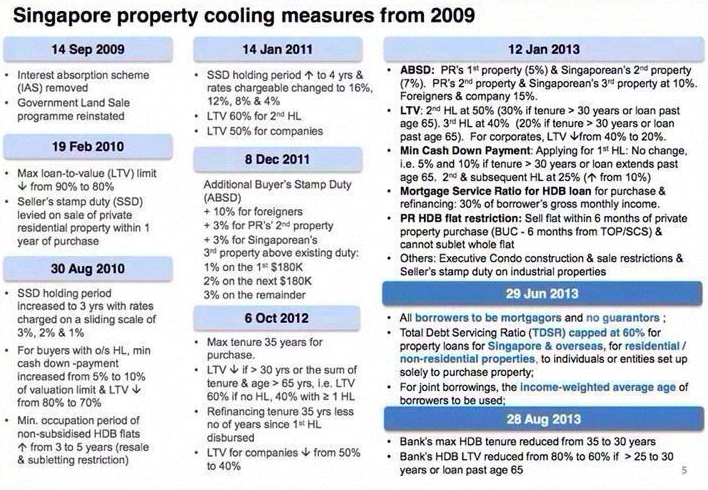

Seller’s stamp duty curbs speculation

According to a study by Ngee Ann Polytechnic, subsales for non-land high-end private homes that were lodged for H1 were from units that were bought between 2009 and 2010. Similarly, in the mass-market segment, 73 per cent of subsale transactions involved properties bought in 2009 and 2010. Since subsales reflect the level of speculation within the market, this trend which shows that subsales involve long-holding transactions, suggests that cooling measures such as the seller’s stamp duty (SSD) have been effective in reducing speculation. Following the SSD scheme, residential properties that were bought from 2011 onward and sold within four years had to incur a maximum of 16 per cent stamp duty fee. According to the study by Ngee Ann Polytechnic, 75 per cent of the 40 subsales in the core central region made profits, while 97 per cent of the 142 subsales in the outside central region profited. Market analysts believe that property sales will remain weak as long as cooling measures are not eased.

(Source: Business Times)

Property consultants say it’s time to lift cooling measures

Property consultants believe that the government’s refusal to lift cooling measures will result in an inflationary effect on the property market as buyers and investors continue to speculate prices. Dennis Yeo, who spoke at the National Real Estate Congress, argued that cooling measures such as the additional buyer’s stamp duty (ABSD) and the seller’s stamp duty (SSD) are less relevant today and should be lifted to reduce property transaction costs. Eugene Lim from ERA Realty, who also spoke at the congress, echoed Yeo’s concerns. He said that the SSD should be removed as subsales across all property types have been slow. Also, he added that while the ABSD imposes a higher tax on foreigners, Singaporeans are still affected by it and may be less able to invest in additional properties. Market experts expect the demand in overseas properties to increase as the cost of local property increases. Nonetheless, Sing Tien Foo from the National University of Singapore believes that it is still unclear how the upcoming increase in residential land supply will affect the consumer behaviour.

(Source: Business Times)

Time to Lift Cooling Measures Singapore?

Where is the Next Best Place to Invest with No ABSD or SSD?

Invest in countries that attracts High Foreign Direct Investments, welcomes foreign labours, which would translate with returns that command higher rental yields than in Singapore.

The Bridge, Phnom Penh, Cambodia – 39% Guaranteed Rental Return by Oxley over 6 years

100 West Makati – 7 to 8% Rental Yield based on current market data

With lower cash outlay and quantum, high rental yield due to limited supply of condos, would it makes sense to invest in those places? You could be one of those savvy investors with 1st Mover Advantage!

Call +65 91898321 to find out how to make your money work harder for you!